From Bitcoin Market to Web3 colonies: How crypto exchanges have evolved over the years

Phemex, an innovative crypto exchange, is at the forefront of the hybrid trading approach. Rooted in a firm commitment to decentralization, Phemex provides CEX-like liquidity, user-friendly functionalities, and access to DeFi opportunities through its Phemexia ecosystem.

Over the years, cryptocurrency trading venues have come a long way — from the Bitcoin Market exchange owned and operated by a single anonymous user, dwdollar, in 2010 to automated market makers (AMMs) relying on mathematical formulas to price assets a decade later.

Centralized exchanges (CEXs) use an order book where market makers and takers place their orders. Their order books then match buyers and sellers, and the exchanges take a small portion of the transaction as a fee. Their counterparts, decentralized exchanges (DEXs), operate via smart contracts — autonomous code snippets on a blockchain, executing transactions. And users pay gas for their activity on the chain.

Trading venues combining features of CEXs and DEXs, nevertheless, exist already and are called hybrid exchange models. For example, Phemex is one of the leading platforms pioneering such a hybrid, semi-centralized exchange structure.

The rise of centralized and decentralized crypto exchanges

However different CEXs and DEXs might seem from the current perspective, the timelines of their evolution overlapped a few times, making these exchange models inseparable from one another in the historical context.

In 2012, initial regulatory concerns began to surface, pushing the centralized exchange founders to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. Over a few years, due to ever-emerging restrictions and decreasing anonymity levels in the crypto niche, the first DEXs, like EtherDelta and IDEX, gained traction.

When the world saw the explosion of initial coin offerings (ICOs) in 2017, there were already such prominent centralized platforms as Binance or Bitfinex, which listed all the new tokens and built a reputation as a result. But despite that popularity, individual crypto traders became increasingly preoccupied with KYC, centralized custody of their funds and possible hacks. The decentralized finance (DeFi) boom of 2020-2021, with $250 billion in total value locked (TVL) as of November 2021, was a solid response to the unnerving tension slowly accumulating over the years in the crypto community.

However, as the years passed, more breaches started happening in DeFi. So, some crypto projects started investing time and effort into researching alternative exchange models. And this is how a semi-centralized trading venue model saw the light of day for the first time, bringing together many benefits, including the security measures of CEXs and the lack of censorship common for DEXs.

So, what other ways can the semi-centralized model contribute to the crypto community?

How do hybrid exchange models work?

The hybrid exchange model is not yet widespread in the niche. However, one crypto trading venue, Phemex, is pioneering the semi-centralized approach in its operations.

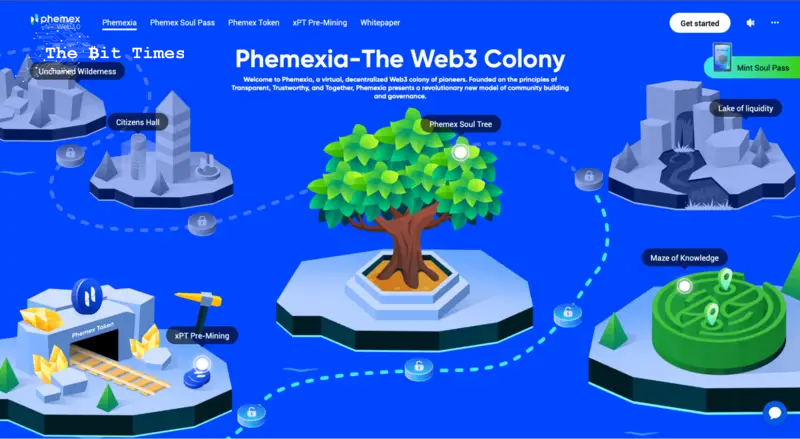

Phemex offers its users the benefits of CEXs, such as robust liquidity, an intuitive user experience, and flexible on- and off-ramps. Beginning in April 2023, the exchange signaled its move toward decentralization and introduced its Web3 ecosystem Phemexia, where holders of the non-tradable soul-bound token Phemex Soul Pass can unlock DeFi opportunities.

To be eligible to mint their own PSP, users have to record at least $10,000 in trading volume over the previous 30 days. But once minted, the pass allows them to accumulate airdrops of xPT, the exchange’s upcoming native token. Users can also propose and vote on the platform’s development in the Phemex DAO, participating in the platform’s growth, operations, financial management and external partnerships.

Source: Phemex

Phemex offers Phemex Soul Pass holders various opportunities and events to use their tokens as much as possible on its DeFi platform. Right now, one of these events is actually in progress. In honor of Satoshi Nakamoto, who introduced Bitcoin (BTC) on October 31st, 2008, Phemex has organized a significant event focused on the world of digital gold. PSP holders are invited to predict the price range of Bitcoin on October 31, 2023. Participants with accurate predictions will have the chance to share a BTC prize pool that may reach as high as 1,000 BTC.

Source: Phemex

This campaign serves as the latest significant benefit extended to PSP holders, following Phemex’s 100 Ether (ETH) giveaway conducted in August. It underscores Phemex’s commitment to providing tangible advantages to its dedicated supporter community while commemorating prominent cryptocurrency projects.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Comments

Post a Comment